Pirelli, placing sustainability in the picture

Carbon Neutrality and welfare are the key words of Pirelli’s new strategic plan. We spoke about this with Filippo Bettini Pirelli Sustainability and Future Mobility officer

The global economy is facing a new crisis. In this scenario, the automotive sector, and in particular the independent aftermarket chain, has to deal with a sharp drop in production and the structural limitations of our National economy, with the concrete risk of delaying any sign of recovery with heavy repercussions on employment. We talked about this situation and how to deal with a new "storm" on the way, with Silvano Guelfi, scientific director of the Automotive independent aftermarket research centre at the Politecnico di Torino.

Professor, what is the health status of the automotive aftermarket sector after the first months of 2020?

The first six months were divided into two parts. Until the end of February, figures were up compared to 2019. On the other hand, the second segment, during the lockdown, months like March and April recorded a minus 50%, followed by a slight improvement towards the end of the semester".

Turning our attention to the entire economic framework, all indicators are showing a minus sign. How much has the Covid pandemic affected this situation?

"The pandemic did not produce the collapse of a healthy economy, it simply laid bare what were the structural limitations of an economy that had been unhealthy for at least ten years. Italy has been in a phase of economic stagnation for far too long. The impact of the pandemic will result in an annual GDP decline, according to Bank of Italy estimates, of about 9 or 10 percent. However, we are talking about a situation that is still not too severe. If, on the other hand, we consider a more drastic scenario, with a second wave of the pandemic and a possible second lockdown, then numbers will become way more dramatic; we’re looking at a GDP drop between 15 - 20 percent".

In this second scenario the impact on employment would be dramatic.

"A GDP at minus 15 percent has a huge impact, and if we look at current employment levels things already appear that way. At the moment the situation is somewhat mitigated by a series of government measures that cannot be considered structural. Therefore, if no clear economic recovery takes place, there will be a time when the risk of going towards much lower employment levels cannot be excluded. Talking about a million fewer jobs is not senseless".

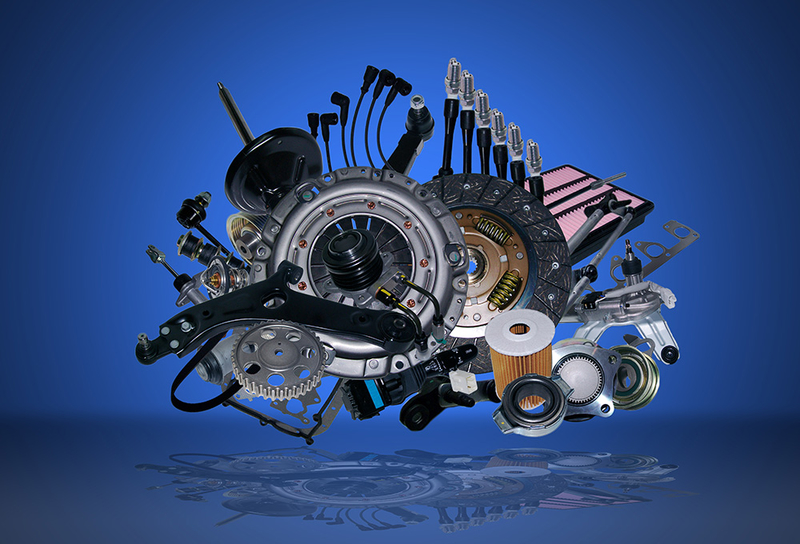

Some companies stopped production during the lockdown, not only because of health issues, but also because many of the components needed to make their products came from Asian countries. How dependent is the automotive sector on suppliers often located thousands of miles away?

"The automotive sector depends on Asian suppliers for a wide number of items both as entry level parts as well as for components that can no longer to be considered as entry level. In addition, many top companies have their spare parts and components produced in Asian countries. This situation affected us, although a bit out-of-sync, as China had to face the emergency earlier but came out of it earlier too, apart from a few returns of outbreak. This should prompt us to reflect on the meaning of globalization on the one hand and delocalization on the other. It is evident, in this phase, that some Italian companies that have not delocalized as much, suffered less than those that heavily outsourced their production. The latter experienced major disruptions in their supply chain. These are phenomena that should make us reflect seriously on this production and development model in a wider sense".

Among the corrective measures proposed, some are sponsoring the idea of creating warehouses in which to store a strategic stock of components, while others insist on reconsidering the entire production system. Which is, in your opinion, the way to go?

"There is a need for a lengthy and careful consideration on whether the solution lies in strategic stocks, to cope with emergencies and lack of supplies, or a new production model. Meaning that, probably, taking into account different points of views on skills, employment and the ability to resist these shortages, it might make sense to rethink where to produce. Lacking a local production chain exposes us to the risk of no longer being able to do anything. This is an issue that goes beyond the current Covid emergency, but is part of a broader discussion that involves relocating. If we transfer our production elsewhere and we become just consumers, it is only a matter of time before tensions are created in the system. Perhaps the Coronavirus will push us to think differently in terms of reorganizing the relationship between production and consumption. Failing to do so could, in the face of future pandemic outbreaks or other disrupting events, result in severe tensions for the entire production system".

What do companies have to be careful about in the coming months in order to deal with this situation?

"Today it is important for companies to have a solid financial balance, and this is because all that has occurred in previous months is bound to result in a lack of liquidity. Companies that have their own structures, production facilities and real estate will certainly be more protected than those who are still forced to bear rental costs. A third important element is to be able to distinguish between useful costs and unnecessary costs. Entrepreneurs need to be far-sighted and able to support, in times of tension, those investments that can create greater opportunities".

Carbon Neutrality and welfare are the key words of Pirelli’s new strategic plan. We spoke about this with Filippo Bettini Pirelli Sustainability and Future Mobility officer

Associations in Motion was held online on June 22nd and was attended by 14 professional aftermarket associations from around the world

Transport prices are skyrocketing along with raw materials with inevitable repercussions on producers' price lists. The trend may be easing a little, but forecasts remain uncertain. We spoke about this with Fabio Bertolotti, director of Assogomma