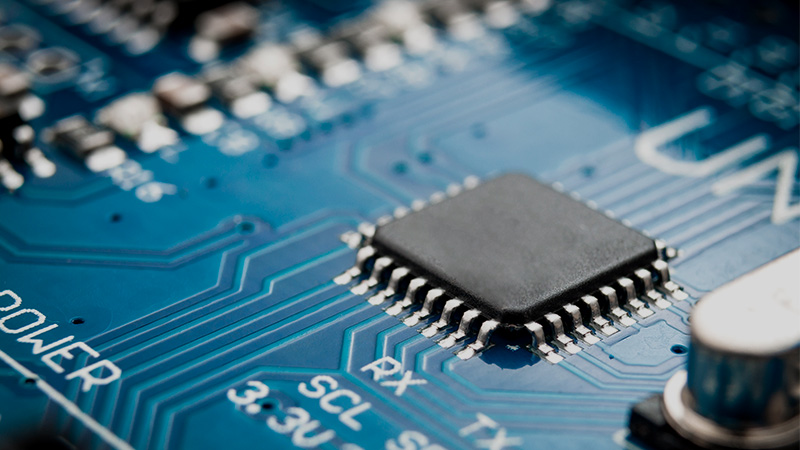

Double trouble: chip crunch and very little is being done on “green policies”

Italy, compared to other large European markets, lacks a strategic plan to support the sector

Buying a new car will become increasingly more difficult due to the semiconductor crisis. Waiting times of more than 200 days are becoming the norm at the time of signing a contract, as is the collection of cars with far fewer accessories than the standard provision. The reason? The lack of semiconductors has been added to other shortages of key materials. In practice, this chip shortage could lead to a drop of 10 million vehicles produced globally, while the Italian market alone could close 2021 with losses of over 30%.

All this will incur seven-figure costs. The global semiconductor shortage will cost the automotive industry $210bn (€180bn) in lost revenues this year globally. The forecast by global consultancy AlixPartners, is up markedly from its last estimate in May ($110bn). In terms of lost production, AlixPartners is now forecasting that production of 7.7 million units will be lost in 2021, up from 3.9 million in its May forecast. ‘Of course, everyone had hoped that the chip crisis would have abated more by now, but unfortunate events such as the COVID-19 lockdowns in Malaysia and continued problems elsewhere have exacerbated things’, said Mark Wakefield, global co-leader for the automotive sector at AlixPartners. ‘Also, chips are just one of a multitude of extraordinary disruptions the industry is facing, including everything from resin and steel shortages to labour shortages. There’s no room for error for automakers and suppliers right now; they need to calculate every alternative and make sure they’re undertaking only the best options’. This is echoed by Dan Hearsch, managing director automotive and industrial practice of AlixPartners: ‘There really are no “shock absorbers” left in the industry right now when it comes to production or obtaining material. Virtually any shortage or production interruption in any part of the world affects companies around the globe, and the impacts are now amplified due to all the other shortages. That’s why it’s critical that companies be armed with good information and analysis to begin with, and that they follow through with flawless, determined execution’. According to AutoForecast Solutions, the impact of the chip shortage could even exceed 10 million fewer vehicles produced, with the record in the States (over 3 million, only 250 thousand recoverable), followed by Europe (2.7 million) and China (2 million, just under 4 including the whole Asian area).

All this will also lead to more expensive cars, as underlined by the study ‘Chip shortages to boost carmakers' pricing power in Europe’ by Euler Hermes (Allianz Group), which analysed the most relevant economic aspects of the sector and hypothesised future scenarios starting from 2022. The analysis starts in Q1 2020 with the arrival of the pandemic and the resulting slowdown in sales, production and procurement. In the first half of 2021, demand for new vehicles in Europe benefited from reopenings, with registrations up 1.4 million units compared to the first half of 2020, although still below pre-crisis levels. Today, however, we are witnessing a clear imbalance between supply and demand that is likely to last until the first half of 2022. The biggest problem is the shortage of chips. The result is that for the first half of 2022, after almost 20 years of restrictions, manufacturers will be prepared to raise prices by 3 to 6% (+4% in Germany, +2.4% and +5.8% in Spain and Italy respectively, and between +0.8% and +5% in France).

Italy, compared to other large European markets, lacks a strategic plan to support the sector

Industrial transition, components, infrastructures, electrification, hydrogen and alternative fuels take the stage

The long process needed to revise the Machinery Directive (2006/42/EC) came to an end on 21 April last, when the European Commission presented the proposal for a new Regulation